A Plan for Sticking to your Budget

Most of us are affected by the global pandemic COVID 19. It’s been more than two months since my country implemented lockdown protocols and eased up on it a bit. Still, I can see businesses closing here and there. In my whole life, this is the first time I’ve seen an event this disruptive that it changed the entire world. The service sector is where it hit the most – gyms, personal services, children’s playgrounds, schools, and small businesses that struggled with keeping up with paying rent and utilities, with no cash inflow.

My friends, we don’t really know for sure what’s going to happen. So we should always prepare for the worst. Actually, it happened already earlier this year, and most of us are doing the best that we can to survive with our finances. You must have already planned some sort of household or personal budget for now, but can you really stick to it?

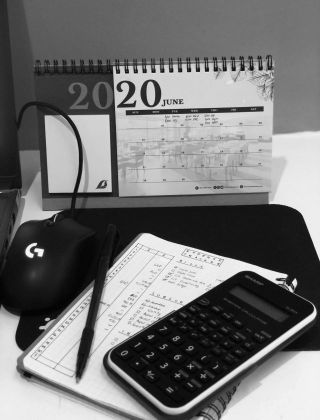

![]()

So you’ve made your budget and it looks good on paper. Great! Now it is time to implement it. But are you ready to follow the budget you’ve developed? Here are some helpful tips to keep you on track with your budget.

Determine why you made a budget.

There is a reason you have put time into developing your budget, now you need to put into writing what your goals are. Do you want to be debt-free, live on one income, or save for retirement? Make this into your personal or family financial mission statement. Write it down or type it up nicely and then have it laminated and display it in a prominent place where you can see it often. Many times we just need a reminder to ourselves why we are doing a particular thing, and that can be just enough incentive when things get tough. You don’t need to be an accountant to start your personal finance journey.

Set small-range goals so you can see progress.

It can be very difficult to keep up the discipline necessary to stay on budget if you can’t see any measurable progress. Develop some short-term goals that you can celebrate meeting. If your goal has been to reduce your grocery spending by Php 2000 per month, then your weekly goal would be to cut grocery costs by Php 500. Likewise, if your goal is to pay off debt, make a chart to show how much you’ve paid off. Reward charts just aren’t for children! Use a type of chart where you can color in a bar to show your progress, and then color it in every time you make a payment so you can see the progress you are making. Put it up on your refrigerator or bathroom mirror as a reminder that your hard work is paying off!

Identify your weak spots and develop a plan to battle them.

In sticking to your budget, you need a clear idea of where you may be tempted to break the budget. If you are prone to impulse spending, then you must remove that temptation from yourself. If you go window shopping, leave your credit cards and checkbook at home! Especially in the early days of sticking to your budget, it is important to re-train yourself to curb spending. Making a budget is really the easy part of financial management. It is sticking to the budget and making your spending match your plan that is a difficult process. By disciplining yourself and retraining your spending habits, you can achieve your budget goals.